Recently (Feb 20, 2024) The Subsurface Task Force posted an interesting article “Geoscience Skills in Crisis”. The piece theorized how existential challenges in attracting young people into geoscience within academia might jeopardize the UK’s ability to achieve its net zero targets.

The situation has been developing for some time they say, with university enrollment data showing a downward trend since 2014. While the UK was the focus of this article, it is easy to see how this can be extrapolated elsewhere, and impact much more than net zero target achievement.

With the above in mind and given our own long-standing participation in the mid-career to senior geoscience talent market, we felt this might be a good time to contribute our own recent experiences. While these do not cover the holistic global market, we hope our insights might be a helpful contribution to the discussion.

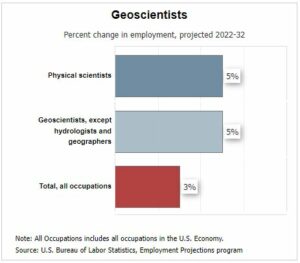

According to the US Bureau of Labor Statistics, “Employment of geoscientists is projected to grow 5 percent from 2022 to 2032, faster than the average for all occupations (chart below.) About 2,200 openings for geoscientists are projected each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.”

However, university bachelor’s degree enrollment data from 2022 presented by the American Geosciences Institute shows a similar picture to the UK. The situation appears significantly worse for master’s programs, that recently dipped below 1970s numbers.

Historic trends in geoscience college enrollments in the US show broad correlation with oil prices. Interestingly, university enrollment trends seen in the US and UK are not seen everywhere – in certain places they remain flat or are increasing. For more details on this an interesting article can be found via Geoscientist Online here.

Today, and as has always been the case, trends in the energy mix are changing specific geoscientist needs. Certain macro catalysts have made the recent trends more pronounced, often leading to hardship for many. Flexibility is required – commodity prices are volatile, with a corresponding knock on effect to employment prospects. However, geoscience roles are often highly specialized and crossing between sub-disciplines is not always easy.

Over the last ten years, The Energists typically completes 8-10 high impact (leadership or individual contributor) geoscience permanent placements per year. As can be expected, specific disciplines have prevailed according to investment activity of the day – from international exploration, deepwater, West Africa, unconventional, evaluations (A&D), and development.

While COVID era demand for high impact geoscience talent was notably below the firm’s historical run rate, it did exist. Over the last 12 months, we have witnessed an increase in demand that is converging with prior levels. Importantly, we are now seeing demand for certain disciplines that have been very quiet for a long time – including senior exploration leaders.

Since COVID our mandates have included an EVP Exploration; VP Geoscience; SVP – Evaluations; Director of Geoscience, multiple fractional evaluation geoscientists, and a Senior Geologist in a multi-jurisdictional deepwater operator. In addition, new demand associated with the energy transition is providing interesting crossover opportunities for some.

The energy transition narrative may have played a role in steering young people away from geology as a university course choice. However, and in conclusion, while geoscience grapples with its challenges, to us it remains a promising career path for those considering tertiary education. As stewards of talent in this dynamic field, The Energists are committed to navigating these challenges and fostering opportunities for the next generation of geoscientists.